Stage 1:

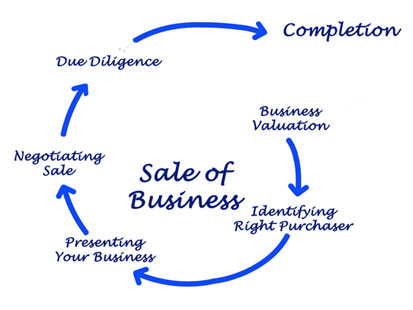

Getting Started with the Sale of a Business

Initial Consultation:

We’d like to get to know you, learn about your business and why you are interested in selling your business by meeting with you. During this time, we will answer any questions or concerns you may have, explain the process of valuing a business and selling a business in more detail.

We will discuss what would be needed from you initially as well as what you can expect throughout the sale process and share how Horizon Business Brokers can help you obtain your goals!

Business Data Collection:

We will gather the past 3-5 years of financial data including Tax Returns, P&Ls, and Balance Sheets. We will also need copies of the current lease, an approximate inventory value, and get an equipment list with approximate values. These items will also be needed for a buyer to make an informed decision and offer as well as obtain any necessary financing.

We will also need to have a general outline of the owner’s day-to-day role and responsibilities as well as anyone the business employs or contracts with, so we understand how each person impacts the operation of the business.

With the financial information and data provided, asking questions to understand the inner workings and details of the business, and researching reference guides and comps databases we will determine a fair value and most probable sale price of the business. Click here to learn more about Business Valuations

Engage Services / List the Business for Sale:

After determining a fair value and most probable sale price of the business and confirming that it is the right time for you to sell your business we will set goals and expectations for price and terms of the sale and we will sign a Listing/Sales Agreement where we will then start the process of marketing the sale of your business. View our current listings

Stage 2:

Marketing the Sale of a Business

Prepare Marketing & Advertising Materials:

With the information already collected and with the assistance of the business owner in supplying anything additional that may be needed, we will prepare the appropriate materials to successfully confidentially market and advertise the sale of the business.

Market Business for Sale:

We will place your business for sale on innovative and popular websites among other nationally searched sites and publications. We will reach out to our very active and constantly growing database of buyers as well as our large network of partners offering your business for sale.

The name and location of your business are never publicly disclosed, it is kept completely confidential until a prospective buyer has completed our Buyers Package and has been deemed professionally and financially qualified.

Interview Prospective Buyers:

We will qualify buyers to see if your business is what they are looking for and if they meet the following requirements:

- They are financially qualified to purchase the business

- They are professionally qualified to operate the business

- They can reasonably obtain any applicable leases, licenses, or franchise agreements

We will assist them with financing if needed and make any necessary introductions to attorneys, accountants or other advisors that they may need to assist them.

Showing the Business & Meeting with Buyers:

Once a qualified buyer has shown potential interest in a business, we will set up an introductory meeting at a mutually agreed-upon location. Initial meetings between buyers and sellers, provide an opportunity for the potential buyer to review the most recent financial data available, speak and meet with the owner and tour the space a business operates from before an offer can be expected.

Stage 3:

Offer and Due Diligence

Offer to Purchase:

Once the buyer has determined that your business meets their goals and interests and that they have a sincere interest this is when an initial offer to buy the business is made. We work with the buyer to help prepare an offer whether that is utilizing a Letter of Intent or a Purchase Agreement with necessary contingencies in place.

We always recommend and encourage that each party engages proper counsel from an attorney, accountant, and other financial advisors before completing and signing any contractual agreements. There may be some back-and-forth negotiations that take place until all the general terms of the purchase are agreed to by all of the parties concerned. An Earnest Money Deposit equal to 10% of the sale price or $10,000, whichever is greater is typically collected from the buyer at this stage to show their good faith and commitment in purchasing the business.

Due Diligence:

This phase is the most important aspect of the purchase for the buyer. They will study the business in as much detail as possible in order to satisfy themselves and their advisers that the business is what they expected when making their offer. During this time we help you provide what buyers really need to see and protect the items that they really don’t need to see until after they complete the purchase of the business.

Due Diligence is also a time for you as a seller to see if the buyer is qualified and capable to operate the business.

This is important since there could be some seller financing as part of the deal or you might even still be liable for any remaining lease or franchise terms where applicable. If seller financing is part of the sale you will want to pay close attention and offer any help the buyer may need in understanding the business during their due diligence. You want to have enough faith in the buyer that they will be able to successfully operate the business and be profitable enough to pay any seller financing you may be offering as well as meet their obligations that you may still be a guarantor of and potentially liable for.

There are certainly all-cash deals made frequently in small business sales, but typically small businesses are sold with the seller holding some financing for a buyer, usually around 10-30% of the total sale price, but it also isn’t uncommon for a seller to finance as much as 80-100% of the sale price of the business. Providing seller financing shows your good faith in the business, opens your buyer pool, helps obtain at or closer to asking prices, and can also help offset tax liabilities from the sale.

If the buyer is satisfied with their findings in due diligence and if both parties are comfortable with the transaction we will proceed to finalize the purchase of the business and move to settlement. Contact us about selling your business!

Stage 4:

Finalizing the Sale of a Business

Assist in Resolving Any Issues:

If there are any issues while performing or coming out of due diligence related to the financial health and performance of the business, operations of the business, the buyer’s ability to secure funding, obtaining the lease or franchise agreement (if applicable), or necessary licenses needed to operate the business we will do our best to work with you, the buyer and any outside advisors to resolve any issues to ensure we can proceed to settlement. It may be necessary to make amendments to the Letter of Intent or Purchase Agreement to extend due diligence or postpone settlement. Contact us about selling your business!

Establish a Definitive Purchase Agreement

If a Definitive Purchase Agreement hasn’t been executed by both parties already (if a Letter of Intent was first established) since this can be done prior to, while in, or after due diligence we would want to finalize the Definitive Purchase Agreement, which can be signed prior to or at settlement.

The Definitive Purchase Agreement is the final agreement that all parties sign which formally defines all the terms of the sale and transfers the business to new ownership.

Funding & Managing Obligations

We want to be sure that 3rd party financing and/or any personal funding to complete the purchase is in place. This is also a time where we will work on finalizing any applicable lease, franchise agreements, and license or permit transfers to transition the business. Once all of these items are in place we can move to settlement.

Settlement:

The settlement is the final process in a small business purchase. An attorney or attorneys for the buying and selling parties draw up and complete the documents necessary for finalizing the purchase. When all terms are agreed to and all contingencies are met, the definitive purchase agreement and closing docs are signed, applicable lease and franchise agreements have been approved and signed, the business is transferred at a formal closing with money and keys changing hands. Contact us about selling your business!

For a Free Consultation Contact Us Today!

Are you interested in selling your business, but don’t know where to start? Contact us to learn how we can help you from start to finish and get the process started today!

Are you looking to value a business, but don’t know how? What is your business worth? What should you offer for a business you are interested in purchasing? We can answer these questions for you. Contact us today to learn more about the valuation process!

Are you looking to buy a business, but don’t know what options are available, what you can afford, or what to offer? We can help, contact us today to get the process started!

YOUR NEXT OPPORTUNITY IS JUST ON THE HORIZON!